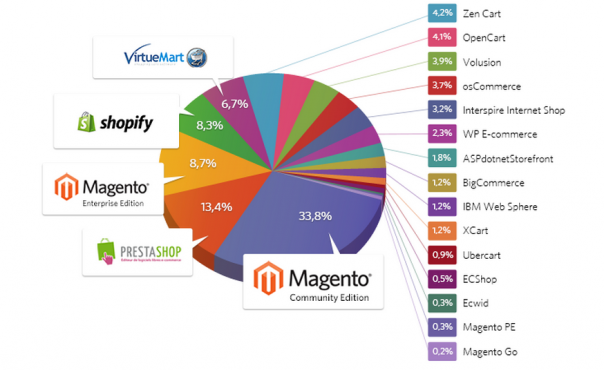

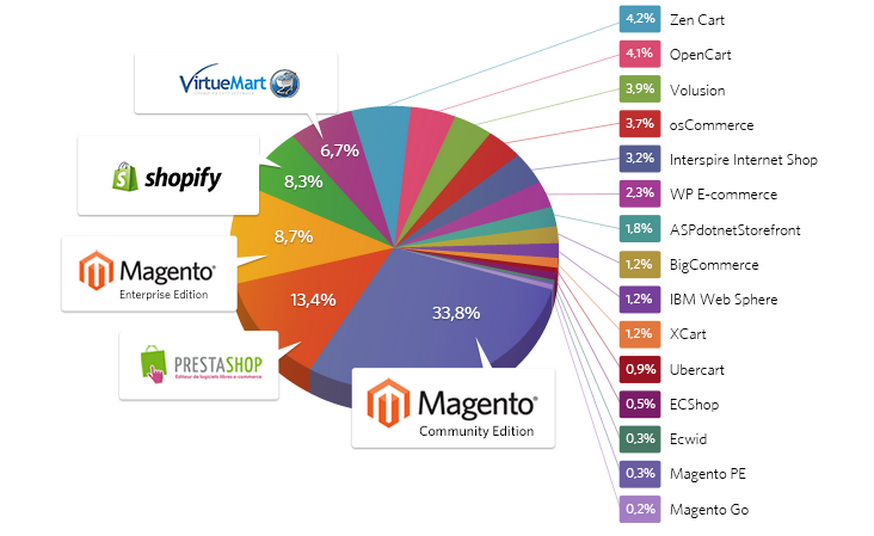

Magento maintains its leadership with 42% of market share of open source e-commerce platforms

Comparative Study: Magento and principal open source e-commerce platform rankings in 2014.

This study is based on the “Alexa 1 Million top sites” index that supplies the breakdown of the e-commerce platforms used by the sites in this index. The second information source, supplied by Google, is the distribution of the search volume of a platform name per country, which allows us to evaluate the interest for an e-commerce platform in the different regions of the world.

It is not a market study in the strictest sense, but more an evaluation of trends and dynamics in place across the globe.

Magento reinforced its global leadership with more than 42% of e-commerce sites polled using the platform.

Magento has increased its leadership in 2013 by increasing faster than its competitors. Prestashop maintained its second place, but the surprise comes from Magento EE (enterprise edition) that approached 9% of market share (+48% in one year) ahead of VirtueMart, Zen Cart and osCommerce.

The different e-commerce platforms behaved in the following way from one year to the next:

- Magento CE (Magento’s free version) went from 29% to 33.8% (an increase of 16.5% over the previous report);

- Prestashop went from 12.3% to 13.4% (an increase of 9%);

- Magento EE (Magento’s paid version) moved from 5.8% to 8.7% (an increase of 48%);

- Shopify went from 3.7% to 8.3% (an increase of 124%);

- Open Cart moved from 3.6% to 4.1% (an increase of 13.9%).

Shopify is the big winner. Last year, Shopify was outside of the TOP 5 e-commerce platforms. This year it took 4th place. Magento EE went from 6th to 3rd place. Remember that Shopify and Magento EE deal with different client and price targets.

Of course, other platforms saw their market share decline:

- VirtueMart declined from 11.3% to 6.7% (a decline of 4.6%, meaning a reduction of 41% of its market share over the previous year);

- Zen Сart went from 7.4% to 4.2% (a decline of 3.2%, meaning a reduction of 43.2% of its market share);

- Volusion regressed from 4.6% to 3.9% (a decline of 0.7%);

- osCommerce went from 6.3% to 3.7% (a decline of 2.6%, meaning a reduction of 41.3% of its market share).

It’s the second year in a row with losses for VirtueMart, Zen Cart and osCommerce.

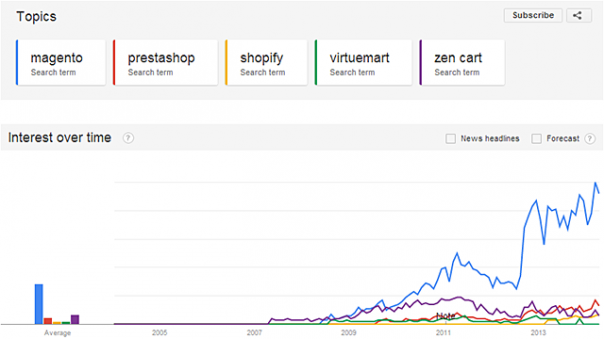

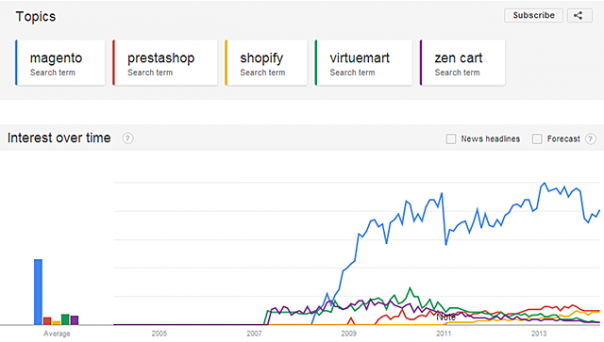

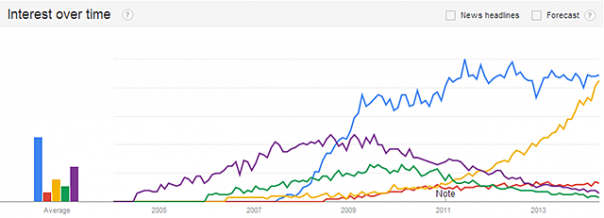

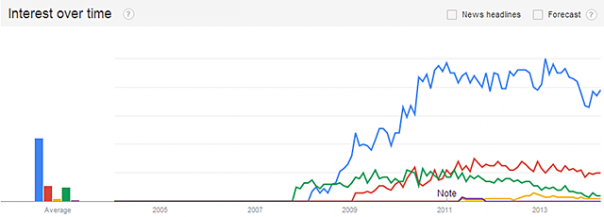

Analysis of Search Volumes using Google Trends.

The search volumes on Google cooroborate the data supplied by Alexa: Magento is the leader and maintains a comfortable lead over the challenger Prestashop. The search volumes indicated by Google correspond to the ranking supplied by Alexa. Shopify has shown a net progression as well.

Interest in Platforms by Country.

Magento draws interest across the globe, as opposed to Prestashop. Shopify dominates only in Australia and North America, with a clear lead. VirtueMart is popular in Central and Eastern Europe. Zen Cart is popular in China, Australia and North America.

It seems that Shopify is gaining mainly at the expense of Zen Cart, but this expansion will have an impact on other competitors if it continues.

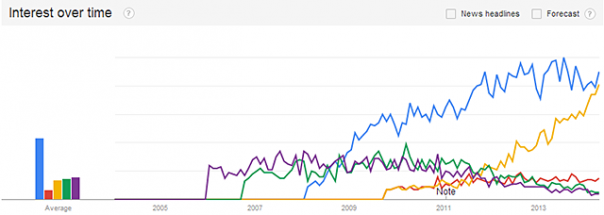

Interest Shown in the Different Regions of the World.

According to eMarketer, in 2016 China will pass the US in terms of the amount of money spent online.

Of course, we can’t consider the search volume as an exact image of the market situation of e-commerce platforms, but it reveals a dynamic of this competitive environment.

Magento is taking root in China, a promising market where, for the moment, the competitive intensity in this field is weak.

Also in India, Magento has a solid advance.

The situation is different in the US, where Shopify a made a remarkable entry over a short period of time. However, Magento is still the leader.

In Australia, like in the US, interest is shared for Magento and Shopify, the other competitors are faced with two leaders.

In Brazil, all e-commerce platforms are losing ground. The economic crisis is contributing to the delay in e-commerce investment, unless consumer behaviour has evolved at the same time.

Conclusion.

- Magento CE continues to grow and is maintaining its leadership across the globe;

- 2013 was a good year for Magento EE;

- Shopify is accelerating its growth, notably in the US and Australia;

- During the past few years, VirtueMart, Zen Cart and osCommerce have lost their roles as leaders.